Life Insurance Ownership: Getting It Right to Protect Your Family

Andrew Coffin

Who gets the money from your life insurance?

It may not be obvious who the owner should be, and brokers will routinely have one person own it for the other, often without much thought or analysis. It is crucial that you name the correct person on your life insurance policy to avoid costly mistakes. If you die, your life insurance needs to be set up correctly so it supports your family rather than creating a badly timed headache.

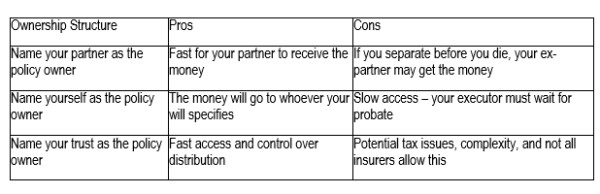

Choosing the Policy Owner: Three Options

Making Your Partner the Policy Owner

If you make your partner the policy owner, they are entitled to the money as soon as you die. While there is some paperwork to complete with the life insurance company, the money will typically be paid out within 1 to 2 weeks (subject to the insurer accepting the claim – which could be a separate discussion). This short timeframe can be crucial if you are the main source of income for your family.

However, if you and your partner separate, they may still be entitled to receive the payout. We often see clients who have separated years ago but forgot to update their life insurance policy at the time – understandably, this is rarely top of mind during a separation. This means someone who is completely disconnected from your current family may receive money that was intended to support your loved ones.

Getting new insurance cover may be more difficult due to age or health changes since the original policy was taken out. Updating ownership of a policy also requires the consent of the current owner – and an ex-partner might not be inclined to agree unless there’s something in it for them. Cancelling the current policy and taking out a new one is another option, but this is often more expensive or provides less cover later in life.

While you could keep a close eye on the legal paperwork and ensure the policy is always in your current partner’s name, the reality is that these details are easy to overlook. Why take the risk?

Naming Yourself as the Policy Owner

If you are the policy owner, the life insurance company cannot pay out to you after your death. Instead, your executor must wait for probate before accessing the funds. In New Zealand, probate typically takes around 8 weeks once the application is filed with the High Court. Some insurers may release a portion of the funds earlier, but this is limited. If your family needs money urgently after your death, naming yourself as the policy owner can be risky.

On the other hand, having your name on the policy gives you more control over who receives the payout via your will. This is particularly helpful if you separate from your partner before you die – you can direct the proceeds to another individual or hold them on trust for the benefit of your family.

While probate allows your estate to receive the funds, the earliest full payout usually occurs six months after probate is granted, and it may take over a year due to statutory timeframes.

Naming Your Family Trust as the Policy Owner

Some (but not all) insurers will allow you to name your family trust as the policy owner. If set up correctly, this can offer the best of both worlds. Because the owner is an entity other than yourself, the insurance company doesn’t need to wait for probate. The trustees simply complete the necessary paperwork and typically receive the funds within 1–2 weeks (again, subject to claim acceptance).

If your trust is well-structured — for example, excluding former partners as beneficiaries and trustees — this setup reduces the risk of the payout going to someone unintended. With clearly defined beneficiaries and trustee powers, trustees can usually distribute funds efficiently and as intended.

However, issues can arise if the trust is not properly established. Inappropriate trustees or vague instructions can result in payouts going to the wrong people. The effectiveness of this option relies heavily on careful trust formation and regular updates.

Taxation is another consideration. Depending on the trust’s structure, the payout may be subject to tax. This is a major downside, given that life insurance payouts are usually tax-free. The same concern arises if you make a company the policy owner. Proper legal structuring is critical to avoid these pitfalls.

The K3 Private Wealth Team

Protect your current and future wealth with K3.

Our team will help you create robust legal structures to safeguard your assets now and in the future. Setting these up correctly ensures they work as intended, simplifies ongoing management, and shields you from potential future liabilities. Our private wealth team specialises in the interrelated legal areas that make these structures effective: trusts, wills, relationship property, powers of attorney, immigration, and overseas investment.

We can assist you with creating, managing, or resolving disputes involving:

- Trusts

- Wills

- Contracting out agreements

- Charities and family trusts

- We also work extensively with accountants, tax experts, financial advisers, insurers, and other professionals to help protect your wealth.

Contact the Private Wealth Team

Helen Edwards

Director

027 944 3405

helen@k3.co.nz

Andrew Coffin

Solicitor

021 063 4267

andrew@k3.co.nz