“Wholesale” Isn’t a Free Pass - and the FMA Is Waking Up the Market

Andrew Coffin

Following the FMA’s decision to escalate concerns to the High Court, it's only a matter of time following a judgment before we see an announcement that “the law was clear all along”. Next, we predict FMA will start knocking on the door of finance companies relying on the wholesale exemptions to convey their dissatisfaction through launching enforcement action. While they’re at it, they might well check on their other bugbears like fair dealing too.

This means anyone relying on wholesale exemptions must stop telling themselves comforting stories like “everyone else does it this way” or “we’ve got a certificate, so we’re fine.”

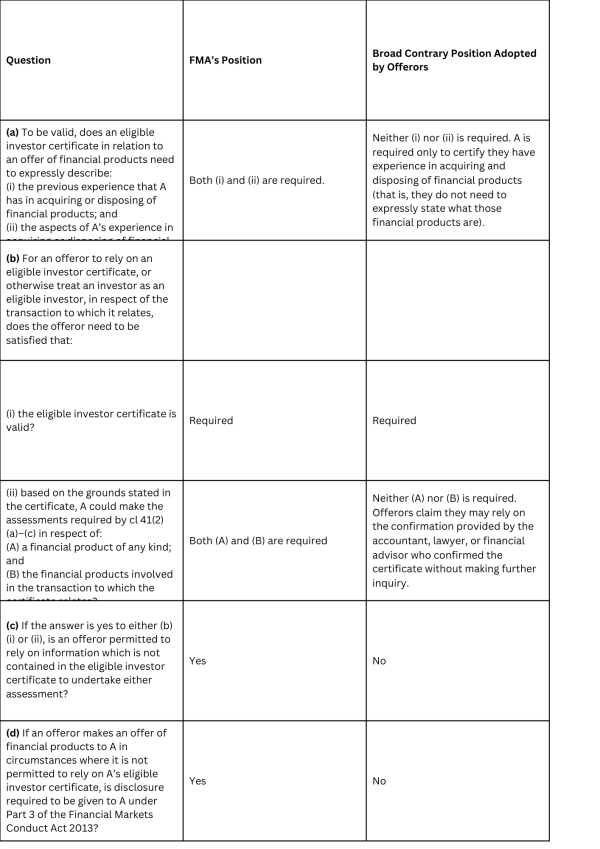

The FMA’s summary table it submitted to the High Court is below, identifying its major differences in opinion it has with offerors. Below the table, we identify further implications of the FMA’s position which they might allege were “obvious”.

If your eligible investor certificate relates to a class of investments instead of obtaining a separate investor certificate for each proposed investment, you may well have a problem. The FMA alleges under (b)(ii)(B) that the wholesale investor certificate assessment must be grounded in the particular financial products involved in the transaction. For example, say you get a wholesale investor certificate for a client for secured lending involving a low risk borrower with an excellent LVR. An investor who has a sufficient investment background to satisfy the requirements for a certificate here might not do so for a higher risk investment opportunity where the LVR is poorer, construction is ongoing, and a heavier emphasis is placed on personal guarantees to secure the lending. This makes relying on using an eligible investor certificate for a class of investments risky at best, even if you are fully across the 2 year time limit you can rely on these certificates for.

You need to be careful about the level of detail provided by investors. The FMA has previously warned that “kiwisaver”, “purchasing a house” etc are not sufficient descriptions to understand if the investor has sufficient experience to satisfy the requirements. The more specific detail the better, even though this can be a hassle for the clients to provide. You also need to take care with how much “help” you provide investors in completing these certificates. If the FMA concludes that your instructions effectively prompted them to copy-paste justifications, it may argue they didn’t understand the consequences; and that you’ve engaged in misleading conduct by omission. As an offeror, you need to turn your mind to whether you agree with the conclusion in the certificate with what you know. It isn’t enough to say your job is done when you receive the certificate from an external professional.

Other issues might include an offeror wanting to refer their clients to independent legal, accounting, or financial advisors to provide eligible investor certificates. We all have networks, but FMA may soon be cracking down on this practice due to concerns around the independence of the advisor. This has been signalled since the FMA’s 2022 thematic review (see page 11) here. It is understandable that financial advisors offering financial products cannot certify the eligible investor certificate for investors seeking to subscribe to their own product. While we believe it is a substantial reach to claim offerors referring investors to advisors have compromised the independence of those advisors, this nonetheless appears to be the FMA’s position.

Separately, take care that any warning statements you provide are word for word identical to what the FMCA and associated regulations require. We have seen examples of the warning statements being altered or multiple documents for different sorts of investors being collated in a way that the FMA might allege that investors were confused. Don’t let this be you!

The FMA is moving from guidance to enforcement starting soon. Don’t wait for the judgment to drop to start complying with the law as it “should always have been understood”. Your next wholesale investor might be a test case, or worse, a witness.